Council conforms to all but one of administration’s recommendations as ongoing wildfire recovery guides MOJ’s 2026 budget

A tied vote defeated a motion to reduce the municipal tax requisition by two percent at councils’ 2026 budget meeting last month.

As such, the proposed tax increase for 2026 is currently $1.15 million, or just under 10 percent above last year’s requisition.

Councillors will discuss the budget on December 9 at their Committee of the Whole meeting, aiming to pass it in their December 16 regular council meeting. Alberta municipalities must adopt their operating budget for the calendar year by January 1.

After two long days of budget presentations from municipal staff, with the exception of recommending to increase the town’s paid parking revenue, Councillor Wendy Hall’s motion for administration to cut $236,000 from its $12.9 million tax requisition was the only motion that did not carry, and was practically the only one that didn’t carry unanimously.

Hall’s motion was also notable because of how it was defeated; only six councillors were present and a tied vote does not carry a motion.

Hall’s intent, she told her fellow councillors, was to find “any last little bit of savings” which would lessen the burden of a proposed 10 percent rate hike on municipal taxpayers.

Her motion would have directed administration to identify roughly two percent of the proposed operating budget “without reducing community group funding,” she said.

“I’d like committee to direct administration to identify and implement $236,000 in reductions… in whatever way they determine feasible…and bring a revised budget back to council,” she said.

As part of municipal contribution requests, 11 community groups were asking council for approximately $250,000 (plus $218K for the library). It was these groups, as well as most public-facing services, as CAO Bill Given intuited, that Hall was attempting to protect from administrative scalpels. Given’s presentation noted a rise in provincial education tax and the town’s Evergreens Foundation contribution, as well as a higher municipal price index and a uncertain global trade conditions. In light of increased costs everywhere else—insurance, building, aging infrastructure and shrinking municipal grants—Hall said she wanted administration to take one last comb-through of town finances.

“The commercial tax is where I worry and seeing those numbers…that’s a big chunk of money for a small business to pay,” Hall said.

But some councillors were uncomfortable with Hall’s motion.

“You can’t just pay two percent less for an elevator maintenance contract and you can’t just reduce your insurance payments by two percent,” councillor Ralph Melnyk suggested.

Coun. Kathleen Waxer said asking administration to find those savings would be downloading an awkward responsibility on staff. Councillor Danny Frechette was struggling, he said, with the idea of “going around the diamond again” and council should take responsibility for its own budget. Hall’s motion “wasn’t in the spirit of the exercise we just went through,” Frechette said.

Then councillor Kable Konsgrud showed his cards.

Konsgrud, who, except to commend staff for their ability to balance the books while ensuring Jasper is well-serviced (“and no, I haven’t drank the Kool-Aid,” he joked), had been notably reserved for the 11+ hours of budget talks, until he explained that he agreed with Hall’s motion. His vote, he said, was a demonstration of trust that administration could “find some wiggle room.”

“I don’t care to make any extra work for you folks, but … let’s see where this works out,” he said, much to his colleagues’ amusement.

Mayor Richard Ireland had originally suggested administration was presenting “what it considers to be a barebones budget to maintain services,” but then he joined Kongsrud in voting alongside Hall, asking administration to shave two percent from their presented numbers.

“Isn’t that interesting,” Ireland said as he tallied the votes, 3-3. “That motion is defeated.”

Had he not logged off earlier in the meeting, councillor Laurie Rodger, who was Zooming in from overseas, would have represented the tie-breaking vote.

Other than those unorthodoxies, which took place near the end of the meetings and which in the end amounted to very little, the only material departure from the 52 page budget document was regarding visitor paid parking; if the amendment is passed on December 19, the Municipality of Jasper will increase its paid parking revenue by $450,000 in 2026 ($1.8 M total).

Apart from that increase, and a $10K increase in the Operations Department’s budget to fund cenotaph improvements in partnership with the Jasper Legion, by and large, council accepted the budget exactly as it was presented to them, without recommending any amendments and in general accepting CAO Given’s rationale that the budget represents a continuity of the previous council’s strategic priorities. Given reminded the attending public that the budget is very much guided by Jasper’s ongoing wildfire recovery goals.

“With homes being rebuilt, infrastructure restored, and interim housing in place, the community’s resilience continues to guide our progress,” Given said in his introduction to the document.

Heads of all municipal departments presented to council over the two day budget sessions, including Jasper’s Director of Recovery, Michael Fark, whose department is unique because 90 percent of its $3.2 million budget is supported by the provincial and federal governments. None of Jasper’s tax requisition goes to the Recovery department, Fark said.

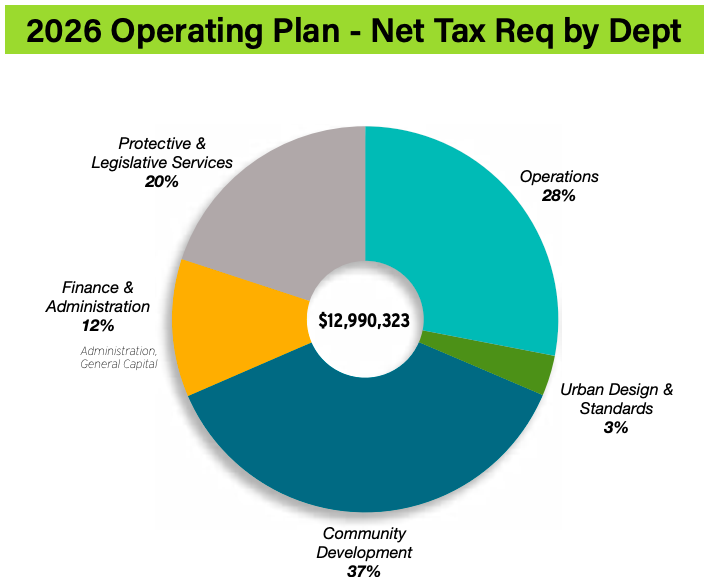

The department requiring the largest net tax requisition will be Community Development ($4.8 M); followed by Operations ($3.64 M); Protective and Legislative Services ($2.59 M); and Finance ($1.5 M). Notable line items in those departments included a $200,000 expansion at the Jasper cemetery (Operations); $604,000 to invest into the aging, leaking fire hall (Protective Services); and a $380,000 financial software overhaul (Finance).

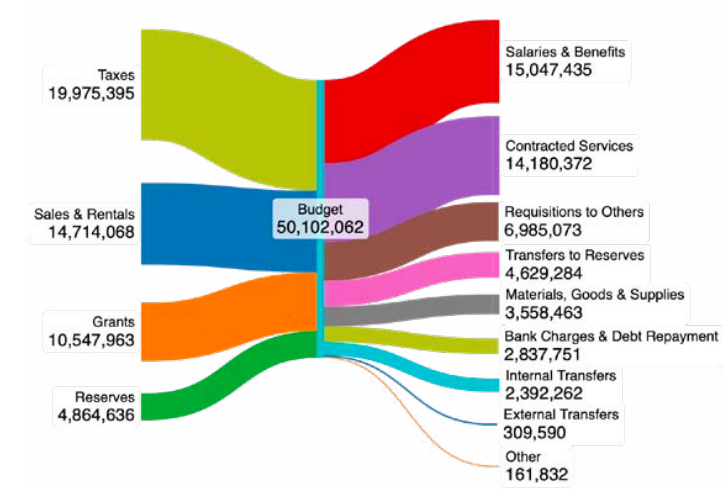

The proposed 2026 budget has a $6.5 million increase in contracted services compared to 2025, but $6.2 M of that is offset by grants and recovery-related funding.

Approximately $10.5 M of Jasper’s $50 M in total revenues will come from grant funding (housing accelerator funding, e-transit funding, community development, and others), according to Director of Finance Natasha Malenchak.

“We’re very good at finding external sources of funding to subsidize the services that residents get,” Given told council in his opening remarks.

The proposed 10 percent tax increase represents just under a $600/year increase in municipal taxes on a residential property assessed at $900,000 and an approximate $3,900/year increase on a commercial building valued at $1 million, according to Given.

Given noted the “baked in” increases of expenses, including an increase in the provincial education tax (+$343K) and Evergreens requisition (+$26K), union raises and wage grid increases (+$835K), as well as increases to debt repayments and stabilization support (+$1.1M).

Provincial education funding is also requisitioned at tax time, even though the municipality merely passes it along to the province. Mayor Richard Ireland pointed out only 43 percent of taxes collected from residents actually go to the town.

“We have to send the bill but we don’t get the money, we’re just the collectors on behalf of the province or other requisition authorities,” Ireland lamented. “The money goes straight out, it’s never spent on municipal services.”

Paid Parking increase

On the heels of collecting $1.35 million in paid parking revenue last year, council voted to increase the revenue it takes in. Councillor Wendy Hall made the motion, noting earlier in the discussion that Banff had recently increased their paid parking rates to $9/hour. Jasper’s is $5/hour.

“That [extra] money would help us support our community groups…and [paid parking] is the only way we get money directly from the visitor,” Hall said.

Administration will come back to council in the new year with recommendations on how to achieve that revenue—whether from raised rates, extending the paid parking season or creating new paid parking zones. Council’s 2026 target represents a 33 percent increase in revenue collected from visitors from 2025.

Fifteen members of the public attended budget presentation meetings at various times throughout the two day sessions, according to the municipal minutes.

The draft budget will come to committee of the whole on December 9, and, barring no major snags or digressions, will then go to the December 16 regular council meeting for final approval.

Bob Covey // bob@thejasperlocal.com